Comunidad Macross Robotech > what is interest cash advance > It truly does work similarly to a corporate bank card

It truly does work similarly to a corporate bank card

Resource fund is normally noticed its sounding business financing, but it’s essentially yet another way of discussing a protected providers loan, with the resource are funded helping as the equity. There are even a couple local rental possibilities (secure lower than) you to fall into the new umbrella away from house funds.

A business credit line gets a debtor usage of good preset amount of financing which are taken on the of just like the needed. Desire is just paid with the number used, so it’s a flexible selection for handling income and layer short-label expenses.

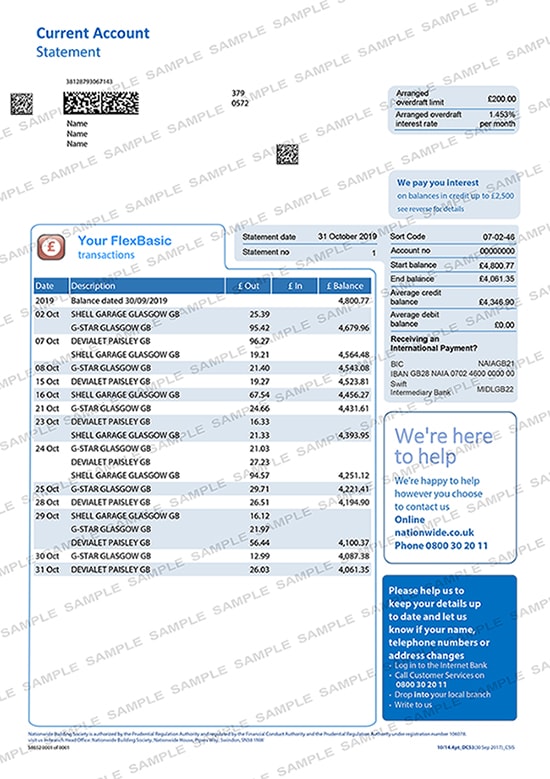

A corporate overdraft lets a corporate so you can withdraw more income than just will come in their membership, up to a specified maximum. This provides you with a safety net to own quick-title income activities helping create unforeseen expenses. Appeal try recharged towards the overdrawn amount.

Invoice loans are an easy method having people to get into finance dependent into the statements owed using their users. That it enhances cashflow by allowing a business in order to efficiently get a progress towards an excellent statements.

The way in which charge funds work varies according to the vendor, on two main possibilities being invoice factoring and you may charge deal.

Lowest doc loans are designed for companies that may not have all the newest financial paperwork normally needed for financing. These financing usually have higher rates and lower borrowing from the bank limitations, but promote less acceptance processes a number of cases.

Bad credit business loans are available to businesses which have circumstances inside its credit score. These funds essentially feature large rates of interest and you will more strict terms on account of the higher risk. However they promote crucial quick-identity financing to own small businesses struggling to safer antique financing.

A money rent relates to a corporate local rental a secured item having a good repaired duration, on option to find the resource at the conclusion of the fresh new lease title. The company leasing the new investment is in charge of fix and contains the risks and you may rewards away from ownership.

A functional lease lets a corporate to book a valuable asset for a shorter several months, generally speaking less than the asset’s useful life. The brand new leasing seller holds ownership and you may obligation having maintenance.

Most well known business loan options today

«Even more businesses want the new freedom of getting a medication lump sum from credit into the set aside, upcoming only drawing off and you can paying rates of interest on what they want. This gives the ultimate freedom even as we navigate so it highest attract environment and you can modifying consumer sentiment.»

How much we need to use and just how long (the loan title), plus specifics of the newest house you should buy (if https://paydayloansconnecticut.com/sherman/ the appropriate).

Profit-and-loss statements, team equilibrium sheet, a corporate plan explaining how you would utilize the funds in order to make funds, plus details of organization cost and exactly how you intend to repay the mortgage.

It is preferable to begin with that with a corporate loan calculator to sort out exactly what your money would be and you can whether you can afford them easily.

Structuring your online business mortgage

«Both key things to consider are: Whenever carry out I have paid down from the my personal members? What can We afford to pay into the an everyday, each week or monthly foundation? Once you learn if you get paid back and how far, deduct any associated expenditures and you may outgoings and your remaining amount is coverage your loan money by the about 120%. Extremely lenders explore what’s titled an effective ‘debt so you’re able to solution cover ratio’ and frequently discover the newest exposure to be no less than 1.2x.»

Something else entirely to keep in mind is that specific will set you back away from having fun with a corporate mortgage, and focus and lots of loan costs, tends to be tax deductible, according to ATO .