Comunidad Macross Robotech > payday loan needed > What are the Benefits associated with Bank Declaration Funds?

What are the Benefits associated with Bank Declaration Funds?

- A lot of dollars supplies on your financial, usually several months’ value of mortgage repayments.

The particular standards vary out-of financial so you’re able to bank. Make sure you comment this new conditions and terms for your lender declaration loan cautiously prior to signing.

Since you you will expect, bank declaration fund features multiple biggest experts which make all of them attractive tools getting domestic home traders, small business owners, and much more.

- Lightweight papers criteria

- Play with twelve in order to a couple of years off financial comments

- Lay as little as ten% off

- Large loan constraints

Lighter Documents Requirements

For just one, the principle advantage of a bank report financing is actually its lightweight documents conditions. To qualify, it’s not necessary to possess proof of employment because of the a big providers, neither do you wish to offer taxation statements.

So long as you provides evidence of income and plenty of bank statements, you might more than likely become approved to own a financial declaration financing for a simple home-based otherwise industrial real-estate. Simply put, cash is the latest restricting factor, not your documents.

Have fun with twelve in order to a couple of years regarding Lender Comments

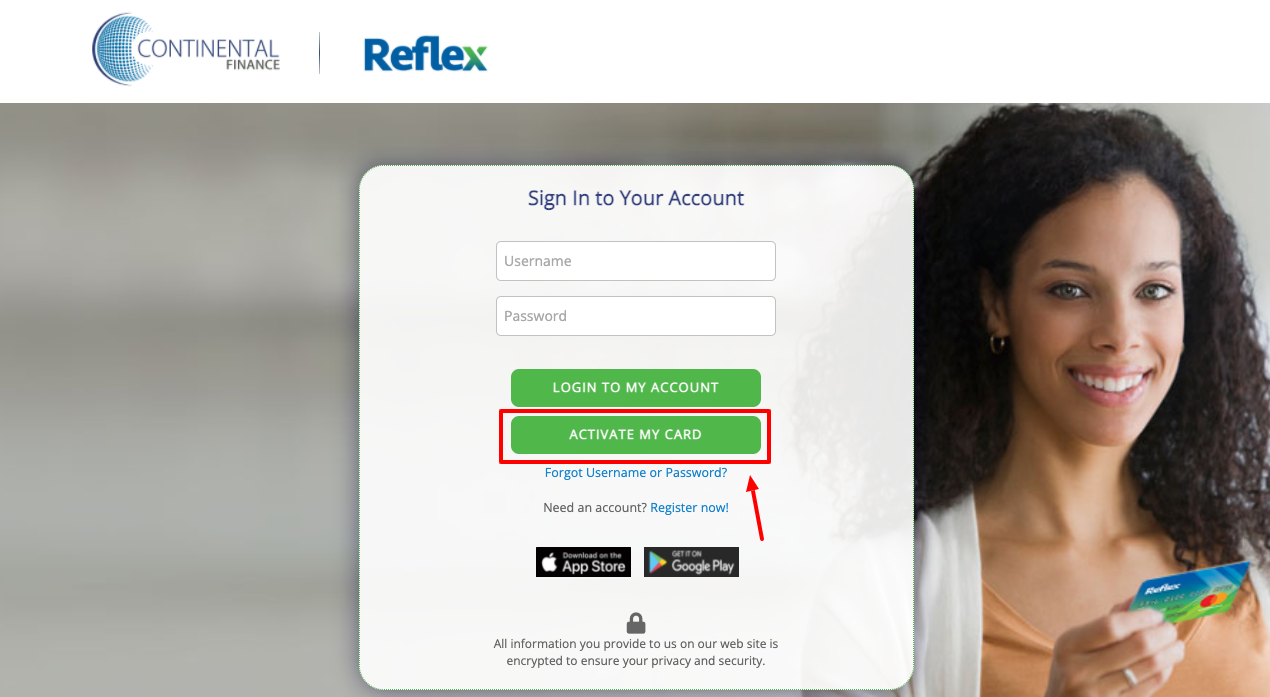

Unlike records such tax returns or W-2s, financial statement fund simply wanted twelve to help you 2 years regarding lender statements as well as a number of other files. You’ll recover this type of from the financial or print all of them away your self from the opening your own bank’s suggestions online. This can be best for those with notice-a job earnings or other nontraditional kinds of money.

Set As low as ten% Off

Some bank declaration money require you to place only ten% off in the place of a higher 20% or 29% deposit. This will make sure that real estate properties a whole lot more open to borrowers otherwise investors, especially those seeking develop their profiles of scratch.

High Loan Constraints

Lastly, of many bank report money promote relatively highest loan restrictions. These grow your to purchase power and might let you buy properties who or even feel from your economic arrive at.

What are the Drawbacks out of Lender Report Financing?

But not, no matter if lender declaration loans do have several benefits, there are a few drawbacks to remember. This type of disadvantages are:

- Large rates

- Highest downpayment should your credit score try lower

- Need to be self-used for 2 years

- Not supplied by the loan providers

Large Rates

For just one, financial declaration loans appear to charges large rates of interest. Whatsoever, the financial institution otherwise bank at issue is actually trying out most risk by lending you money in place of W-2s, taxation models, or other supporting files.

Might require increased Down-payment

While some lender statement fund possess low-down fee standards, someone else may have much higher down payment standards – all the way to 35% or higher.

Again, this all boils down to the lender under consideration; specific banking companies are more risk-averse and require higher down costs so you’re able to offset the highest observed chance.

Need to be Notice-Used for Two years

If you attempt to obtain a lender declaration loan as the a self-employed private otherwise builder, you want two years out-of notice-employed background so you can be eligible for extremely contracts. This shows your care about-functioning company is stable which the lending company is believe you to definitely help make your commission all the recharging years.

Maybe not Supplied by All Lenders

The past prospective downside to bank declaration funds is that you aren’t able to find all of them at each bank. Only a few lenders promote lender statement money after all, plus a lot fewer promote high-high quality lender statement financing having accessible conditions and lowest degree requirements. Thus, you may need to hunt for a while payday loans online Oklahoma to get the right bank report financing for your requirements.